C-Store Valuations

|

The Convenience Retail Experts

|

|

Enter subhead content here

Our Appraisal Reports Include:

Enter content here

Please Click Here to View "Supply and Demand" Video (5 min). Please Click Here to View "Hypermarket Competition" Video (4 min).

APPRAISAL APPRAISAL INSPECTION Robert E. Bainbridge and store owner Kurt Anderson walk a new-build site in Helotes, Texas. APPRAISAL APPRAISAL The sections below describe a few of the basic considerations in the valuation and appraisal of convenience stores and gas stations. We hope you will find this information helpful. You may quickly provide us with a few of the details about your appraisal and valuation request by submitting the form below. Please be as complete as possible. You may click the SUBMIT BUTTION to send the information to us. VALUATION OF OPERATING ASSETS Our appraisals include the estimated value of the total assets of the business (TAB), which includes

the tangible and intangible assets; also known as Going Concern Value. This Going Concern Value is allocated as follows

among the various contributory components. The merchandise, food and fuel inventories are not included. APPRAISAL ●Land (As if Vacant) ●Real Property Improvements

●Furniture, Fixtures & Equipment ●Business/Enterprise/Franchise

Value APPRAISAL Our appraisals provide an opinion

of the market value for the following value premises:

Part 1 of the Report The fee simple estate for the tangible and intangible assets.

This value is based on market-level earnings for stores of the subject's particular physical configuration at the subject's

specific location under typical management. The fee simple value does not rely on the operator’s historic (actual)

profit and loss statements. The fee simple value is based on how a typical operator would perform with the subject’s

real estate assets at the fixed location. Because this is the fee simple value, this value is irrespective of the existing

brand, supply and service contracts. APPRAISAL Approaches used

in Part 1 of our appraisals: APPRAISAL Capitalized Earnings Approach ·Developed

for the Tangible Assets, Real Property. ·Excess earnings estimates, if any,

applied to value estimate

of Intangible Assets. APPRAISAL Sales Comparison Approach. ·Developed for the Tangible Assets, Real Property. APPRAISAL Cost

Approach

·Developed

for the Tangible Assets, Real Property. ·Developed for Tangible Assets, Non-Realty (FF&E). VALUATION VALUATION Part

2 of the Report The

value Under Current Operations. This value is based on the business’s ability to generate earnings under the

existing supply contracts, branding agreements, and historical financial performance, and current management. EVALUATION Business Operating Agreements (BOA) and branding agreements for the

convenience store or gas station are not part of the recorded title to the real property. Often these contracts do not

automatically transfer with the sale of the real estate. In many cases, these agreements either terminate upon the transfer

or are renegotiated between the new parties, if the property sells. EVALUATION The

value Under Current Operations assumes the existing business operating agreements remain in place and that the quality

and depth of management remains unchanged. This estimate is more of an economic performance measure, which can

show for example, the current business’s ability to satisfy the debt requirements of the fee simple interest. EVALUATION The value estimate of the real estate and other physical assets of the property Under Current Operations

is limited in its applicability and should not be assumed to reflect transferable market value. In the event of

foreclosure, the value Under Current Operations will likely not be realized by the mortgagee, or Deed of Trust beneficiary. EVALUATION Approaches used

in Part 2 of our appraisals: APPRAISAL Capitalized Earnings Approach ·Developed for the Tangible

Assets, Real Property. Excess earnings estimates, if any, applied to

value estimate of Intangible Assets. APPRAISAL For the reasons above, rather than expressing a

value estimate, this economic characteristic is usually included in our appraisal reports as an index. APPRAISAL AAA

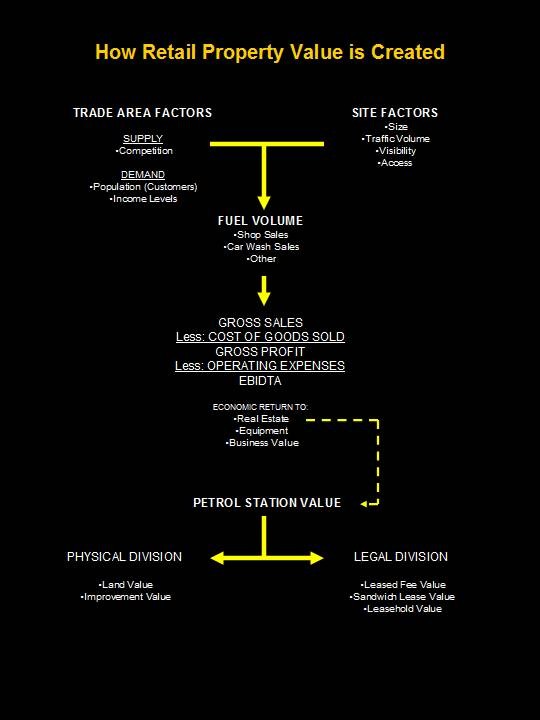

HOW

RETAIL PROPERTY VALUE IS CREATED Real estate is one part of the assets of any business enterprise. When the

real estate improvements are designed for a specific use and cannot be easily adapted to alternative uses, then the market

value of the improvements is dependent upon the capabilities of the business model to be successful for the use for which

they were designed. APPRAISAL REPORT The fundamental observation is this: buyers will pay more for a business that earns a lot of

money, as opposed to one that does not. VALUATION REPORT The value of specially-designed retail real estate, such as convenience stores and gas stations,

is residual to the business operation. Real estate is one of the last economic claims on earnings, after cost-of-goods

sold and labor, and other operating expenses. When more money is left over after these business expenses, the value

of the underlying real estate is higher. In other words, for convenience stores and gas stations or any retail property,

NOI to real estate comes from the cash register. VALUATION OF GAS STATIONS This capacity for the business to generate

earnings or profits is, at least to some extent, dependent upon the physical characteristics and location quality of the real

estate. This is why some buyers pay more for certain locations than for others. APPRAISAL OF GAS STATIONS The diagram below

illustrates how value is created for specially-designed retail real estate, such as gas stations and convenience stores. APPRAISAL Using an "Earnings Capitalization"

as shown here is the best way to estimate the value of convenience stores and gas stations.

The diagram above shows how real estate value is created from the earnings of the business enterprise. This

is why buyers will pay more for the real estate associated with locations that have higher earnings.

Please Click Here to E-Mail C-Store Valuations. APPRAISAL C-STORES VALUATION

OF C-STORES ©

COPYRIGHT 2004-2015 ROBERT E. BAINBRIDGE. The content of this website is copyright protected. All Rights Reserved.

|

|||||||||||||||||||||